-

Community Banks Craft Business Cases as Real-Time Payments No Longer Optional

Cheryl Gurz of The Clearing House and Tara Campbell of GBank discuss what is holding banks back from adopting instant payments.

37:58

-

Payments CEOs Say Uncertainty May Be the New Normal. But Getting Back to Business Takes Center Stage

Boost Payment Solutions CEO Dean Leavitt and Ingo Payments CEO Drew Edwards discuss how companies can navigate today’s economic uncertainty.

30:55

-

Panel: The Future of B2B Commerce is Balancing Innovation With Risk Management

FinTech innovation and partnerships with traditional institutions is helping to move more business payments digital. Tribh Grewal, head of FinTech partnerships at Discover Global Network, and Jonathan Vaux, head of propositions and partnerships at Th

20:00

-

Point-of-Care Payment Options Expand Access to Dental Care for Patients

Dr. Steven Rasner, DMD, MAGD, of Pearl Smiles, and Ed O'Donnell, CEO of Versatile Credit, tell Karen Webster that offering financing options at the point of care can keep patients from biting off more than they can chew when it comes to holistic, fee

34:59

-

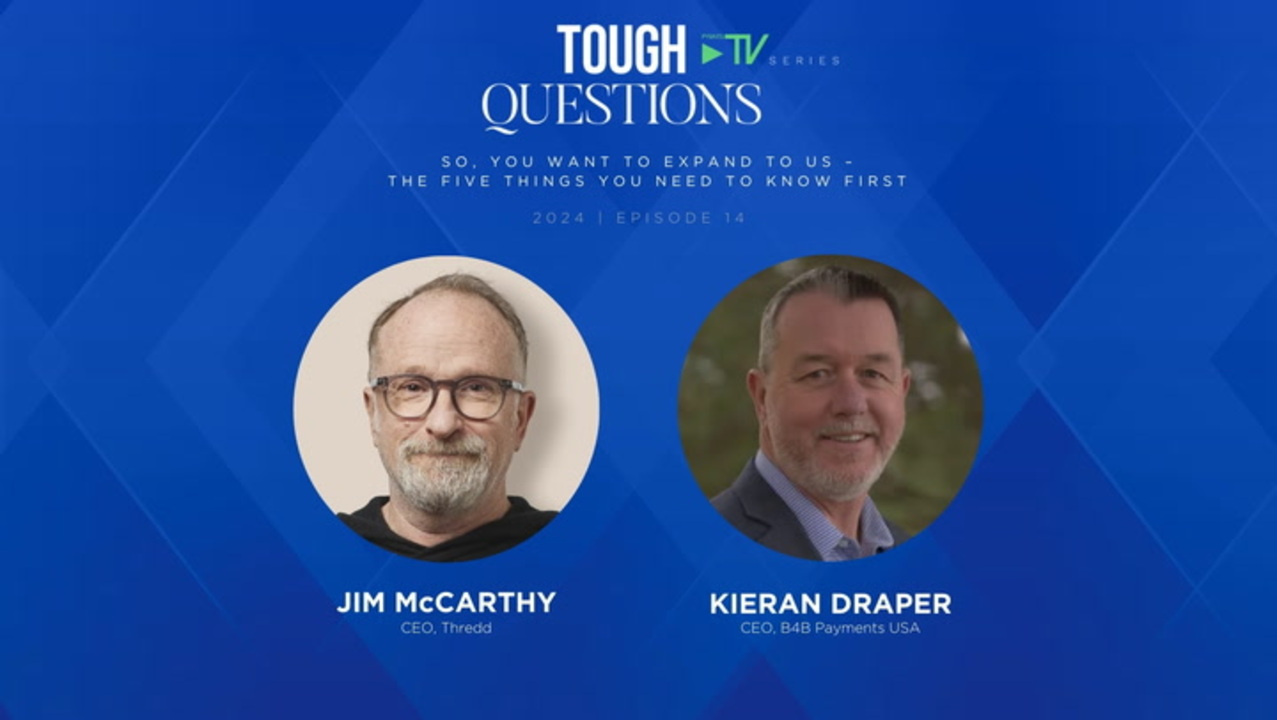

FinTechs Looking to Enter the US Market Better Be Sponsor-Bank Ready, Says Thredd's McCarthy

Take it from two executives who have done it. Thredd CEO Jim McCarthy and B4B Payments CEO USA Kieran Draper have both led their companies to U.S. market entry and they give PYMNTS' Karen Webster the benefit of their experience. Their insights cover

40:00

-

Banking-as-a-Service Focus Turns to Managing Financial Crime Risks

With the Synapse disruption looking more contained, the focus now turns to managing third-party relationships. Alena Robertson, BaaS manager at Grasshopper Bank, and Chris Caruana, vice president of strategy at Hawk, explored managing the risks and r

20:00

-

Banks Need 'Change Management Checklist' in Battle Against Fraud

Chris Caruana, VP of Strategy at Hawk AI, Ramon Ramirez, director of AML/KYC Operations at Western Alliance Bancorporation, and Miguel Navarro, head of Client Identity Verification and Authentication at KeyBank, tell PYMNTS that banks need to answer

46:36

-

Virtual Cards Set to Transform Buyer-Supplier Relationships

Virtual cards are reaching a tipping point as both B2B buyers and suppliers turn to them as a key a source of payments certainty. That's according to a recent PYMNTS panel discussion of industry heavyweights that featured Robin Boudsocq, head of comm

30:41

-

AI Proves Effective in Stopping eCommerce Returns Fraud

Doriel Abrahams, head of risk, U.S., at Forter, and Richard Kostick, CEO of 100% PURE, discuss the use of advanced technology and high-touch efforts to avoid the "rocks in the box" returns that create a wedge between consumers and merchants.

30:00

-

Are Real-Time Payments Near an Inflection Point? Bank of America Thinks So

Margaret Weichert, chief product officer at The Clearing House, and Irfan Ahmad, managing director and head of U.S. Payments, GTS, at Bank of America, tell PYMNTS that B2B and consumer-focused payments are ripe for a transformation as real-time payme

30:27

-

Arculus, Mastercard and Truist Explore Fraud and the Economy's Three S's

As Truist head of enterprise payments Chris Ward put it: "Consumers today operate in what I call the three S's of the economy: speed, simplicity, and safety." Those were the headlines from this exclusive panel discussion as Ward joined CompoSecure Ch

20:00

-

Rite Aid CMO Says Innovation Keeps Customers a Click Away From the Competition

In today's digital age, where competition is just a click away, loyalty programs have become cornerstones of customer retention and satisfaction. Rite Aid Chief Marketing Officer Jeanniey Walden and MoneyLion CMO Cynthia Kleinbaum Milner discuss the

30:00

- Load More