From Data to Decisions: How AI is Optimizing Invoice-to-Cash and Payments

44:58

AI is reshaping the invoice-to-cash lifecycle, Flywire executives Ryan Frere and Chris Couch tell PYMNTS in an exclusive webinar.

Related Videos

In PYMNTS ON AIR

-

Play video AI-Powered Intelligence: The New Advantage for CFOs

AI-Powered Intelligence: The New Advantage for CFOs

Raj Seshadri, Chief Commercial Payments Officer at Mastercard, explores how AI and data are giving CFOs new ways to manage cash flow, working capital, and risk, while mobilizing partners across the B2B ecosystem to accelerate growth.

15:38

-

Play video AI and the New Era of B2B Payments

AI and the New Era of B2B Payments

For our sixth annual B2B Payments event, PYMNTS Chief Content Officer John Gaffney sits down with CEO Karen Webster to open four weeks of conversations on how artificial intelligence is reshaping B2B payments.

15:18

-

Play video SMBs and Unified Commerce — Playing Big in a Mobile-First World

SMBs and Unified Commerce — Playing Big in a Mobile-First World

In episode three of our video interview series with Visa Acceptance Solutions, we turn the spotlight to small and medium-sized businesses (SMBs) and their journey toward unified commerce.

11:45

-

Play video Where CFOs Are Betting on AI and Why

Where CFOs Are Betting on AI and Why

Emanuel Pleitez, Head of Finance at Finix, explores how AI is being used to streamline reconciliation, improve forecasting accuracy and strengthen cash flow management.

20:04

-

Play video The Rise of the Mobile-First Shopper — What Every Merchant Needs To Know

The Rise of the Mobile-First Shopper — What Every Merchant Needs To Know

Learn why 6 in 10 shoppers worldwide now browse merchant websites on their smartphones multiple times a week — and how nearly half of these “anywhere window shoppers” make a purchase when inspiration strikes.

9:05

-

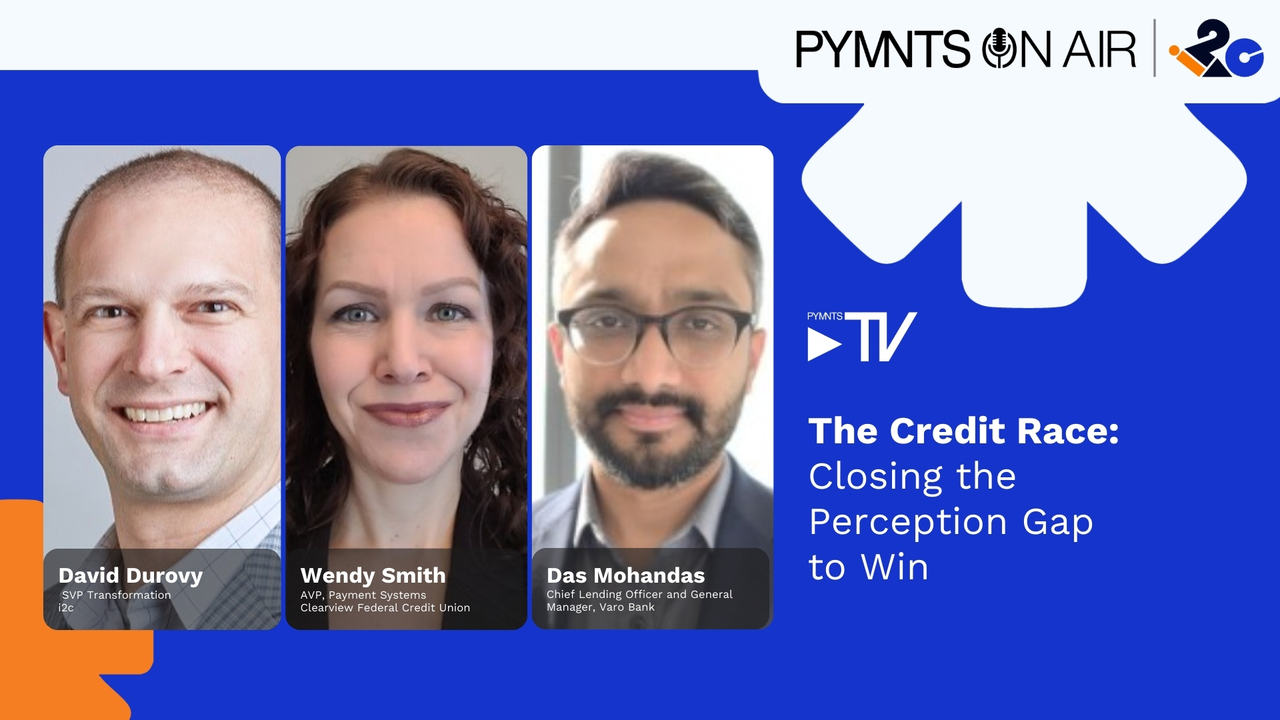

Play video The Credit Race: Closing the Perception Gap to Win

The Credit Race: Closing the Perception Gap to Win

Hear from leading voices in payments as they share how processors and issuers are tailoring products and engagement strategies to capture both sides of the credit economy.

38:09